Your profits just increased 14%, what are you going to do with all that cash?!

Large U.S. companies are on tap to reap the benefits of a 21% corporate tax, down from 35% (not factoring in Effective Tax Rates), under the new federal tax bill. There are many theories on where the money will go.

Several companies have already given out bonuses, announced minimum wage increases, increased 401k matches, offered stock buyback programs, and increased shareholder dividends. While all these are great short term shots in the arm during a time of robust economic growth, I'd like to argue that the smart play would be to invest in operational and energy efficiencies to prepare for an economic pullback and eventual awakening of the bears.

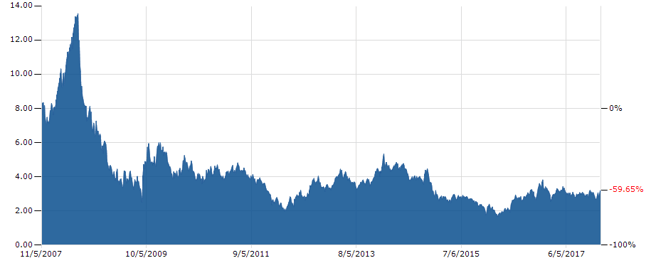

Fortunately, for many companies this recent time of growth has come over a period in which energy prices have been relatively flat, or declining, resulting in reduced expenses and increased profit margins. The rates for natural gas are slightly above 10-year lows and electrical pricing has shown a modest increase of 3% on average across the U.S. It would be short-sided and foolish to think these rates will remain near basement levels for the long term as geo-political flash points or natural disasters could lead to sharp increases in rates. Unless businesses invest in efficiency now, they're not going to be able to react fast enough to counter the cost of an increase should an event occur or prices quickly rebound.

Source: Market Insider

Even at today's rates, most mainstream energy conservation measures (ECMs) fall at or under the industry benchmark of a 3-year Simple Payback Period or ~33% ROI. Despite the bull market running wild, it can be difficult to find a relatively risk-free investment that will yield a consistent 33% return. Therefore, the smart money will point toward investing in efficiency projects now in favorable capital markets.

My bet is that most "Main Street Americans" would rest easy at night knowing their investment will yield a consistent return north of 30%. There's likely not one silver bullet technology that will drastically improve operational efficiencies; however, there are many proven low-risk investments such as LED lighting, HVAC upgrades, building management systems, and smart building controls that can have an impact on many areas of your operations. This multi-faceted approach to energy efficiency will build a more robust infrastructure and predictable energy usage profile for business operator for when the economy eventually pulls back and rates increase.

I'm not an economist, investment banker, trader or tax analyst, but I do manage a global business and believe in growth reinvestment balanced with the protection of downside risk. So, if you're a building owner, asset manager, facility manager or responsible for the financial performance of your business, I urge you to mitigate your future operations' cost risk and invest in efficiency today.

Contributed by Randy Miles